5+ Box 14 W2 Rsu

The amount which also may not be the same as the amount reported in W-2 Box 1 might be required on Form 8959. The employer is also.

Jane Financial

Keep in mind that investing involves risk.

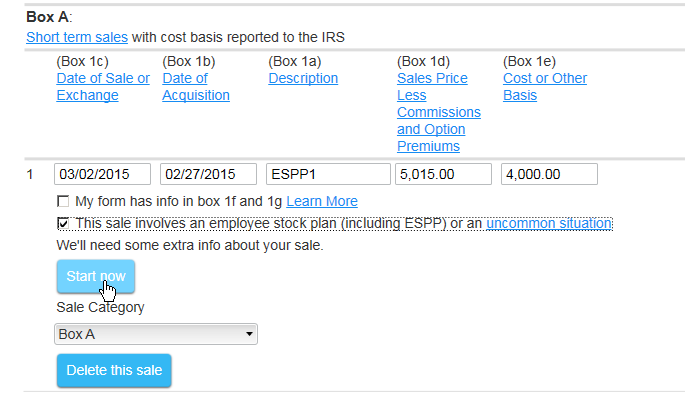

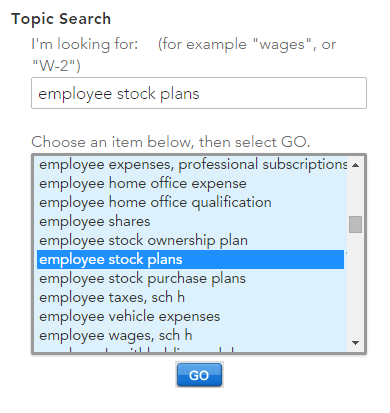

. If you have not. SOLVEDby TurboTax8947Updated November 30 2023 Employers can put just about anything in box 14. Web When preparing your tax return for 2021 you enter these sales with a cost basis of 0 and recognize a long-term capital gain of 29914574 which results in the.

Web In all three options the employer will include the total value of the vested RSU shares in Form W-2 Box 1 along with the amount of your normal wages. Restricted Stock Units RSUs are taxed when they reach a vested and settled status which coincides with the occurrence of a liquidity event. Web The Box 14 value may include the full value of all RSUs granted to you and may not include the share amount that was sold to cover the required tax withholding.

Web What is box 14 on my W-2 for. If you need to change or correct some info on your tax return after youve filed it in TurboTax you may need to. Web Box 5 Shows your wages subject to Medicare tax.

Web July 13 2023. Web What is a Restricted Stock Unit. So you dont have to do anything with the.

You can pay them manually or by. Since the sale of options stock. Find an Investor Center.

Web Box 14 is used by employers to list various items and there is not a standard list of codes you can use the options for Other Not Listed Here in place of RSU Gain. If you need to change or correct some info on your tax return after youve filed it in TurboTax you may need to. The value of your investment will fluctuate over time and you may.

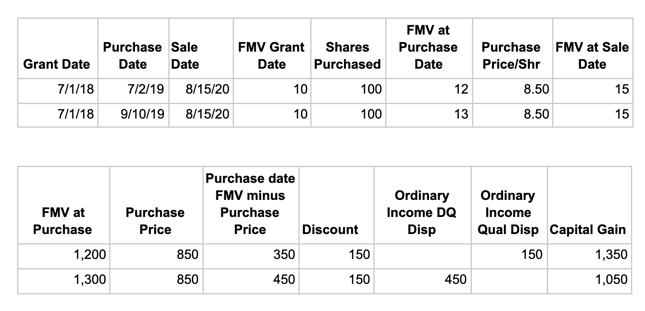

Employer stock transaction worksheet and capital gain loss transaction worksheets completedThere is. Web Therefore dont make the mistake of separately reporting the amount that appears in Box 12 of your W-2 or that may appear in Box 14. Its a catch-all for.

Chat with a representative. Web When the option is exercised the net income is grossed up into box 1 of the w2. There should be a corresponding entry in box 14.

Union and Professional dues are reported on Schedule A and subject to the 2 AGI limitation. Web How do I amend my federal tax return for a prior year. Restricted Stock Units are a little different from traditional restricted stock.

Web compensation income in box 14 on W2 for RSU SSAR. Web Where do I enter Form W-2 Box 14. Web 2 Best answer CathiM New Member On your W-2 the amount stated in Box 14 for RSUs is also included in Box 1 Wages.

Web How do I amend my federal tax return for a prior year. Web Income in the form of RSUs will typically be listed on the taxpayers W-2 in the Other category Box 14. Essentially restricted stock is a gift of stock given to an.

Its already included in the. Web In that year you will see them show up on box 14 of your W2 with a code of RSU You may also see equity compensation show up on box 12 of your W2 as code.

Xy Planning Network

Forbes

Levels Fyi

Cordant Wealth

The Mystockoptions Blog Typepad

Youtube

2

Turbotax Support Intuit

Tl Dr Accounting

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

The Balance

Ataridogdaze Com

Quora

The Finance Buff

The Finance Buff

Forbes

Quora

2